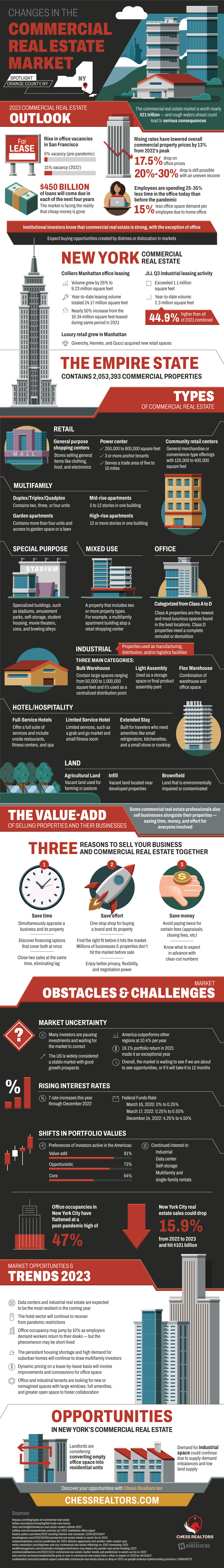

The real estate market is in choppy waters right now, but opportunity remains for shrewd investors. 2023 trends predict a continuation of the uncertainty caused by Covid-19, with many investors pulling out and waiting for the market to correct itself before starting new projects. Interest rates are rising, and planned layoffs at Goldman Sachs and the 2022 Twitter/Meta layoffs could potentially damage demand for commercial real estate. Despite most people returning to work, office occupancy has peaked and stabilized at only 47%. New York stands to have real estate sales drop 15.9% in 2023.

However, there is hope for those looking to invest smartly. Some markets, like data centers and industrial real estate, remain very strong. The hotel sector is expected to continue to grow, and the housing shortage along with a high demand for houses in the suburbs will likely attract multifamily investors. Those returning to office spaces are looking for modern spaces with plenty of light and collaborative spaces. In New York specifically, landlords are converting empty office space into housing units. Silverstein Properties in Manhattan is raising 1.4 billion dollars to do just that. Demand for industrial space is likely to continue, and a 49% increase in tax revenue for hotel occupancy is expected from 2022 to 2023.

Source: ChessRealtors.com

More Stories

Dr. Beth Shapiro and Colossal Biosciences: Charting the Course for De-Extinction

Unleashing Unlimited Entertainment: Exploring StreamEntertainment’s Film and Series Catalog

How to Attract More Visitors to a Local Park